With the continuous improvement of material living standards, people increasingly pay attention to emotional needs, through raising pets to seek companionship, sustenance of emotions. With the expansion of pet raising scale, people’s consumption demand for pet supplies, pet food and various pet services continues to rise, and the characteristics of diversified and personalized needs are increasingly obvious, driving the rapid development of the pet industry.

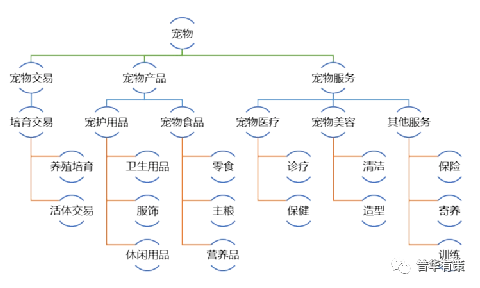

After more than 100 years of development, the pet industry has formed a relatively complete and mature industrial chain, including pet trading, pet supplies, pet food, pet medical treatment, pet grooming, pet training and other subsectors. Among them, the pet supplies industry is an important branch of the pet industry, the main products include pet home leisure products, sanitary and cleaning products, etc.

Source: PWC

Related Report: Pet Industry Segment Market Survey and Investment Prospect Forecast Report (2022-2028) by Beijing Puhua Youce Information Consulting Co., LTD.

1. Overview of foreign pet industry development

The global pet industry sprouted in Britain after the industrial revolution, started earlier in developed countries, and all links of the industrial chain have developed relatively mature. At present, the United States is the world’s largest pet consumption market, Europe and emerging Asian markets are also important pet markets.

(1) American pet market

The pet industry in the United States has a long history of development. It has experienced the integration process from traditional pet retail stores to comprehensive, large-scale and professional pet sales platforms, and the industrial chain is quite mature at present. The US pet market is the largest pet market in the world, featuring large number of pets, high household penetration rate, high per capita pet consumption expenditure and rigid pet demand.

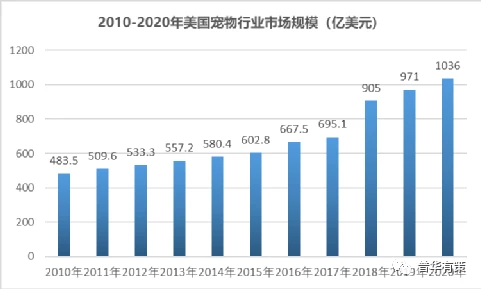

In recent years, the scale of the American pet market has been expanding, and pet consumption expenditure has been rising year by year with a relatively stable growth rate. According to the American Pet Products Association (APPA), consumer spending in the U.S. pet market reached $103.6 billion in 2020, surpassing $100 billion for the first time and up 6.7% from 2019. During the decade from 2010 to 2020, the U.S. pet industry grew from $48.35 billion to $103.6 billion, a compound growth rate of 7.92%.

The prosperity of the pet market in the United States is due to its economic development, material living standards, social culture and other comprehensive factors. So far, it has shown a strong rigid demand, which is little affected by the economic cycle. In 2020, due to the impact of COVID-19 and other factors, the U.S. GDP grew negatively for the first time in 10 years, down 2.32% from 2019. In spite of the poor macroeconomic performance, pet consumption expenditure in the United States still showed an upward trend and maintained a relatively stable growth rate, with an increase of 6.69% compared with 2019.

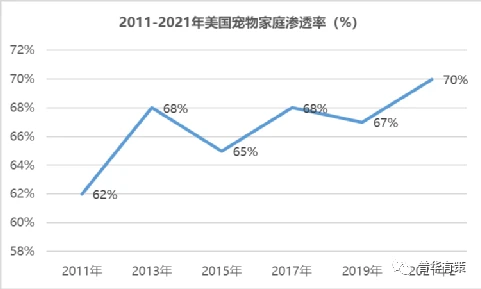

American pet households have a high penetration rate and a large number of pets. Currently, pets have become an important part of American life. According to APPA, about 84.9 million U.S. households owned pets in 2019, accounting for 67% of all households nationwide, and that percentage is expected to rise to 70% by 2021. It can be seen that pet culture has a high popularity rate in the United States. Most American families choose to keep pets as companions, and pets play an important role in American families. Under the influence of pet culture, the American pet market has a large number and scale base.

In addition to the high penetration rate of pet households, per capita pet consumption spending in the United States is also the highest in the world. According to publicly available data, the US was the only country in the world to spend more than $150 per person on pet care in 2019, far more than the UK, which ranked second. The per capita consumption expenditure of pets is high, which reflects the advanced concept of pet raising and pet consumption habits in American society.

Based on the comprehensive factors of rigid pet demand, high household penetration rate and high per capita pet consumption expenditure, the pet industry market size in the United States ranks the first in the world and can maintain a stable growth rate. Under the social soil of popular pet culture and strong demand for pets, the pet market in the United States has been continuously integrated and extended, resulting in many large domestic or cross-border pet product sales platforms. For example, comprehensive e-commerce platforms such as Amazon, comprehensive retailers such as Walmart, pet supply retailers such as PETSMART and PETCO, pet supply e-commerce platforms such as CHEWY, pet supply brands such as CENTRAL GARDEN, etc. The above large sales platform has become an important sales channel for many pet brands or pet manufacturers, forming product collection and resource integration, and promoting the large-scale development of the pet industry.

(2) European pet market

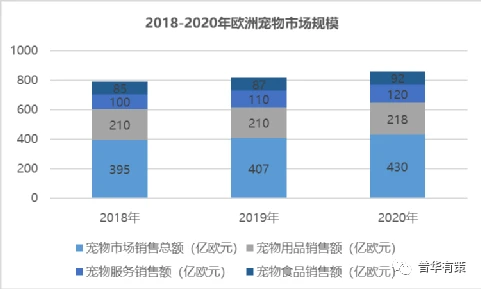

At present, the European pet market shows a steady growth trend, and pet product sales are expanding year by year. According to the European Pet Food Industry Federation (FEDIAF), the total consumption of pets in Europe in 2020 reached 43 billion euros, an increase of 5.65% compared to 2019; Among them, the sales volume of pet food, pet supplies and pet services reached 21.8 billion euros, 9.2 billion euros and 12 billion euros in 2020, with an annual increase compared with 2019.

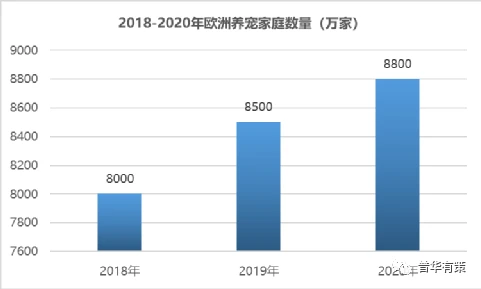

The European pet market has a high household penetration rate. According to FEDIAF data, about 88 million households in Europe have pets in 2020, with a pet household penetration rate of about 38%, an increase of 3.41% compared to 85 million in 2019. Cats and dogs are still the mainstream of the European pet market. In 2020, Romania and Poland have the highest household pet penetration rate in Europe, with the household penetration rate of cats and dogs reaching about 42%. This was followed by the Czech Republic, where the penetration rate was over 40%.

2. Development overview of domestic pet industry

(1) Economic growth drives the rapid development of the pet industry, and the pet consumption market expands year by year

Compared with foreign pet market, Chinese pet industry developed late, started in the early 1990s. In recent years, with the economic development and the change of consumption concept, the pet industry of our country enters the rapid development stage. At present, our pet industry has a certain scale, and pet dog and pet cat are still mainstream. According to the White Paper on China’s Pet Industry, the total number of pet dogs and cats in cities and towns in 2020 exceeded 100 million, with 52.22 million dogs and 48.62 million cats, accounting for 51 percent and 46 percent of the total number of pet owners in cities and towns, respectively.

With the improvement of residents’ income level and life quality, the concept of pet raising has gradually changed from “home care” to “emotional companionship”. Many pet owners and families regard pets as close family members, and their demand for pet supplies and pet food is increasingly diversified. In addition to main food, they also buy daily necessities, toys, snacks and travel supplies for pets. According to the White Paper on China’s Pet Industry, the annual consumption per capita per pet in urban China has exceeded 5,000 yuan since 2018, and will reach 5,172 yuan in 2020. With the change of people’s consumption concept of pet products and food, the pet industry resources are gradually differentiated and integrated, forming pet supplies, pet food, pet medical and other subsectors.

Driven by multiple factors such as the increase in the number of pet owners, the growth of the number of pets and the diversification of consumption, the market size of the pet industry in China is constantly expanding. From 2010 to 2020, the pet consumption market increased rapidly from 14 billion yuan to 206.5 billion yuan, with a compound growth rate of 30.88%.

(2) The rise of domestic pet enterprises, gradually transforming from OEM mode to independent brand

Due to the early start of the foreign pet industry and the limited space of the domestic pet market, the early domestic pet industry manufacturers were mostly OEM factories of foreign manufacturers. With the rapid development of domestic pet industry, domestic pet industry manufacturers have gradually broken the traditional OEM mode and directly face consumers by creating their own brands. Many domestic enterprises, including Yiyi Group, Petty Group, Sinopet Group, Yuanfei Pet and Zhongheng Pet, have opened the product market through their own brands.

(3) Domestic pet family penetration rate is low, and the market development space is large

Since the pet industry has gradually emerged since the 1990s, it is relatively late for pets to change from the function of tools to the additional function of emotional companionship. At present, the concept of pet raising in China is still in the process of establishment and popularization. Developed countries with an early start in the pet industry have a considerable scale of pet industry chain. In 2019, the penetration rate of pet households in the United States reached 67%, and in Europe, the penetration rate of pet households reached 38%. By contrast, the current penetration rate of pet households in China is still far lower than that in Europe and the United States and other countries and regions.

At present, the low penetration rate of pet families brings huge growth space and development potential to the domestic pet market. In recent years, with the rise of the concept of pet ownership in China, the domestic pet industry has entered a stage of rapid development, with the pet consumption market size exceeding 200 billion yuan in 2019. In the future, with the popularization of the concept of pet keeping, the penetration rate of pet families will be further increased, and the scale of the pet market will be increased accordingly.

(4) The main body of pet consumption presents a younger distribution, with the post-80s and post-90s as the main force of consumption

With the rapid development of the pet industry in our country, the change of pet concept is more to influence the young people’s lifestyle. According to the White Paper of China’s Pet Industry, in the group structure of pet raising in 2020, single people account for 33.7%, in love 17.3%, married with children 29.4% and married without children 19.6%. Pets have become the emotional companionship of single people and the emotional catalyst of marriage and family. Is playing an increasingly important role in People’s Daily life.

Due to differences in education background, lifestyle, growth environment and other aspects, young people have a relatively high degree of acceptance of the concept of pet raising, and have higher emotional needs for pets. The population of pet raising people shows an obvious distribution of younger people. According to the White Paper on China’s Pet Industry, the post-80s and post-90s generation is still the main force of pets, accounting for more than 74 percent of pet owners in 2020. It is expected that the post-00s will gradually become the main force of pet consumption in the future.

3. Industry development opportunities

(1) The downstream market scale of the industry continues to expand

With the increasing popularity of the concept of pet raising, both foreign and domestic markets, the market scale of the pet industry has shown a trend of gradual expansion. According to the data of the American Pet Products Association (APPA), as the largest pet market at present, the market size of the pet industry in the United States increased from 48.35 billion dollars to 103.6 billion dollars in the ten years from 2010 to 2020, with a compound growth rate of 7.92%; According to the European Pet Food Industry Federation (FEDIAF), the total consumption of pets in the European pet market will reach 43 billion euros in 2020, an increase of 5.65% compared to 2019; The Japanese pet market, a large one in Asia, has shown a steady but rising growth trend in recent years, maintaining an annual growth rate of 1.5% to 2%. In recent years, the domestic pet market has entered a stage of rapid development. From 2010 to 2020, the pet consumption market scale rapidly increased from 14 billion yuan to 206.5 billion yuan, with a compound growth rate of 30.88%.

For the pet industry in developed countries, due to its early start and mature development, it has a strong rigid demand for pets and pet-related food products, and is expected to maintain a stable and rising market size in the future. As an emerging market of pet industry, China’s pet industry is expected to maintain a rapid growth trend in the future based on economic development, the popularity of pet raising concept, changes in family structure and other factors.

To sum up, the deepening and popularization of the concept of pet raising at home and abroad has driven the vigorous development of the pet and related pet food products industry, and will usher in greater business opportunities and development space in the future.

(2) Consumption concept and environmental awareness promote industrial upgrading

Early pet products only meet the basic functional requirements, single design function, simple production process. With the provision of people’s living standards, the concept of “humanization” of pets is increasingly popular, and people are paying more attention to the comfort of pets. Some countries in Europe and the United States have issued laws and regulations to strengthen the protection of the basic rights of pets, improve their welfare benefits, and strengthen the supervision of municipal cleaning of pet keeping. Related multiple factors promote people’s requirements for pet products continue to rise, and their willingness to consume continues to strengthen. Pet products also present multi-functional, humanized, fashionable, accelerated upgrading, and increasing added value of products.

At present, compared with the developed countries and regions such as Europe and America, pet supplies are not widely used in our country. With the increase of pet consumption willingness, the proportion of buying pet supplies will also increase rapidly, and the resulting consumption demand will strongly promote the development of the industry.

4. Industry development challenges

In recent years, with our pet industry entering a stage of rapid development, the domestic pet industry is not only grasping the opportunities but also facing challenges.

In terms of industry development environment, as a subsector of light industry, pet supplies industry started relatively late in China and has not yet formed an orderly industrial ecology. The domestic pet products market has not yet established a stable and large-scale sales channel, and the cost of enterprises to develop new domestic markets is relatively high, which increases the difficulty of enterprises to expand the domestic market scale.

In terms of independent brand construction, at present, a considerable number of domestic pet supply enterprises have weak independent research and development ability, limited investment in independent brand construction, and low brand awareness, which leads to vicious price competition in the low-end product market, which is not conducive to the healthy development of the industry.

In terms of international trade environment, most of our large-scale pet products production enterprises mainly sell for developed countries such as Europe and America, and the changes of trade policies in destination countries have a great influence on product exports. Under the influence of trade protectionism policies in some countries, the profit space of domestic pet enterprises may be compressed to a certain extent, bringing certain adverse effects to the development of the industry.

Post time: Dec-01-2022